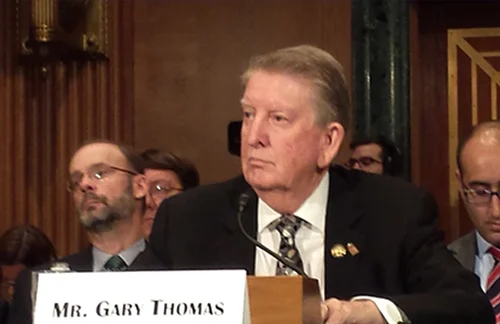

Since the Government Shutdown ten days ago, the world has been closely listening to the bickering between officials and watching for the effects on nearly every major industry in the nation. With all the back and forth and conflicting reports, it's difficult to decipher what is fact and what is speculation. Riskin Associates has been following the major developments, and today the headlines hit particularly close to home. Today, NAR president Gary Thomas went before the Senate Committee on Banking, Housing and Urban Affairs to discuss the foreseeable negative effects a debt default would have on the housing recovery. Thomas calls on Congress to raise the debt limit to avoid the consequences of a severe and drawn-out recession.

To quote Mr. Thomas, a default would be "devastating to homeowners whose largest asset would lose value and equity." In regards to home buyers, Thomas says "Home buyers would see a dramatic increase in interest rates and tighter credit standards." According to Thomas, a 1% increase in mortgage rates could cut home sales by nearly half a million and push many middle-class Americans out of the housing market. In his speech, Thomas urged Congress to raise the debt limit to help sustain the housing market rebound, which will allow to economy to maintain it's steady path to recovery.